It holds 7,206,276 shares valued at 245.09 million. The iShares Core S&P Mid Cap ETF, which owns about 2.37% of GME stock, is the second-largest Mutual Fund holder. A total of 7,677,286 shares are owned by the mutual fund manager. With a 2.52% stake in GME, the Vanguard Total Stock Market Index is the largest stakeholder.

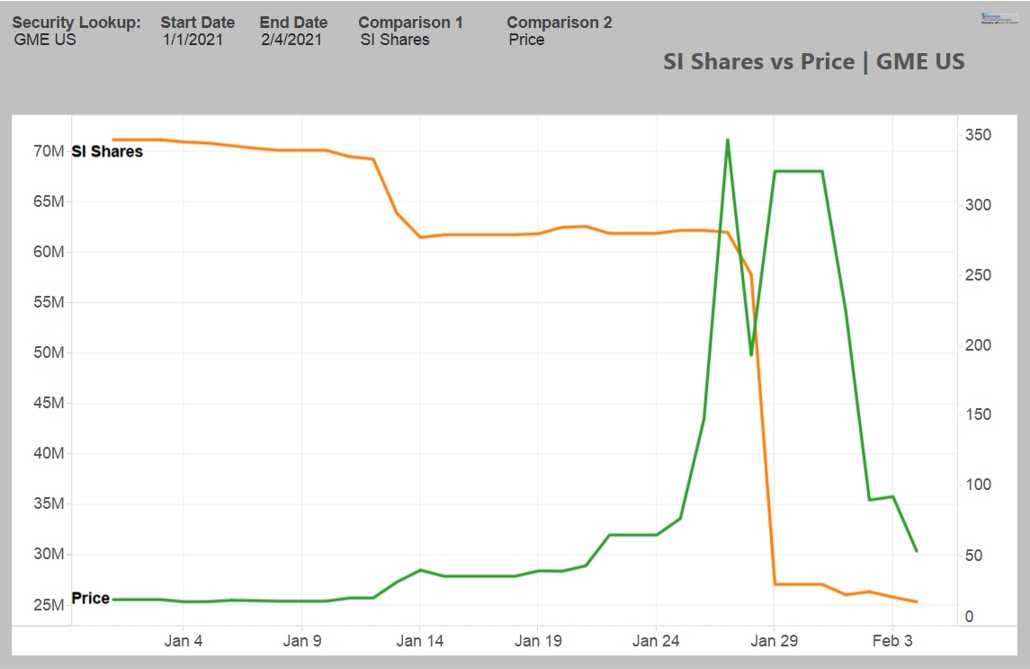

is the third largest shareholder in GME, holding 6,801,164 shares or 2.23% stake. A second-largest stockholder of GME, BlackRock Fund Advisors, holds 19,079,608 shares, controlling over 6.27% of the firm’s shares. As the largest shareholder in GME with 7.73% of the stake, The Vanguard Group, Inc. Shares owned by individuals account for 18.17%. Other institutions hold 8.24% of GME, in contrast to 3.45% held by mutual funds. Through their ownership of 27.99% of GME’s outstanding shares, institutional investors have minority control over the company. Matthew Furlong as the firm’s Pres, CEO & Director, Ms. On Jul 14, 2022, short shares totaled 59.62 million, which was 19.58% higher than short shares on Jun 14, 2022. Float and Shares Shorts:Īt present, 304.20 million GME shares are outstanding with a float of 256.96 million shares on hand for trading. This implies an EPS growth rate of -59.10% for this year and -10.90% for next year. For the next quarter, that number is -0.28. A look at the trailing 12-month EPS for GME yields -1.71 with Next year EPS estimates of -0.84. The stock lost -38.57% in the past year, while it has lost -21.18% so far this year. Three-month performance dropped to -9.40% while six-month performance rose 26.18%. The price performance of GME was up-trending over the past week, with a rise of 6.87%, but this was down by -25.88% over a month. Stock performance is one of the indicators that investors use to determine whether they will profit from a stock. Sponsored Price Performance and Earnings:

#Gme short float free#

Sign up here to get your free report now. In fact, within our report, "Top 5 Cheap Stock to Own Right Now", we have identified five stocks we believe could appreciate the most even if you just have $1,000 to invest.

Business questions regarding the short interest reporting deadlines should be directed to Yvonne Huber at (240) 386-5034, Jocelyn Mello-Gibbon at (240) 386-5091 or Lauren Zito at (240) 386-5432.While finding safe stocks with the potential for monster gains isn't always easy, we've found a few that could pay out well.Questions regarding system requirements, file uploads and related submission problems should be directed to (800) 321-6273.Questions regarding the information that firms need to file can be directed to the appropriate District Office.

Firms that file their short interest positions via an ASCII text file should use the trade date of Novemwhen populating Record Type 2, Field 6 of the file. There are two trade dates that settle on November 15, 2022. All referenced times are reflected as Eastern Time.Ģ. 2022 Short Interest Reporting Dates Settlement Dateġ. See the schedule of reporting dates below. Eastern Time on the second business day after the reporting settlement date designated by FINRA. All short interest positions must be reported by 6 p.m. FINRA requires firms to report short interest positions in all customer and proprietary accounts in all equity securities twice a month.

0 kommentar(er)

0 kommentar(er)